by David Fox, Professor of Common Law, University of Edinburgh*

Questions of state finance rarely figure in litigation before the domestic courts, and the economic instability wrought by the First World War is now a subject for the books on financial history rather than a problem of practical investment. (For the history, on which this note relies, see Burk, Britain, America and Sinews of War 1914-1918 (1985) and Strachan, Financing the First World War (2004)). In 1937, however, both were live questions before the House of Lords. In R v International Trustee for the Protection of Bondholders Aktiengesellschaft [1937] A.C. 500 the Lords engaged with the perennial conflict between contracting parties’ freedom to hedge against economic risk and a state’s sovereign power to control the monetary system. Although the state in question was the United States of America rather than Great Britain, the court’s recognition of America’s sovereign power worked to the financial advantage of the British government. The government found the value of its war debts reduced.

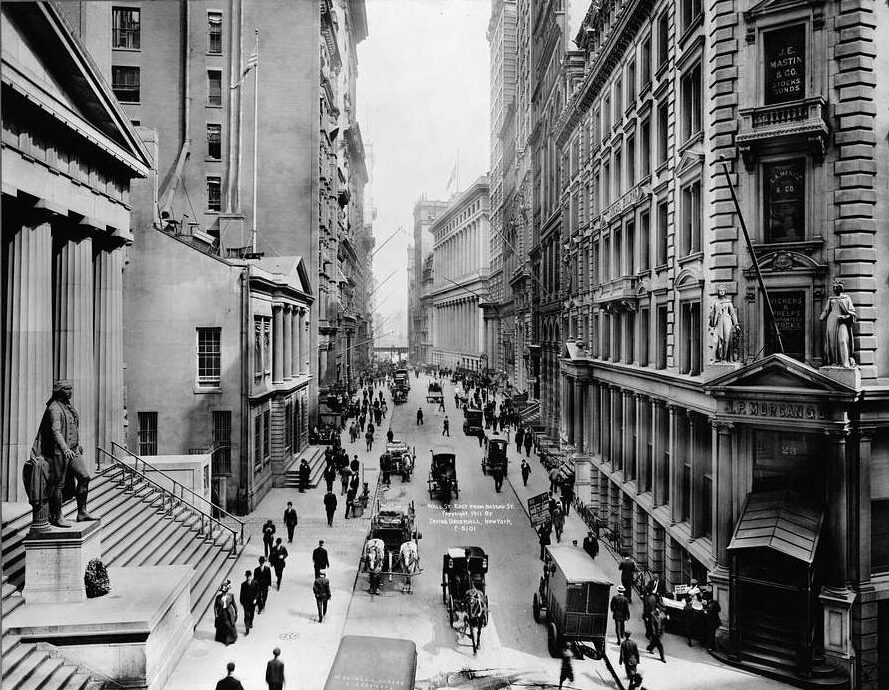

The House of Lords interpreted the gold clauses in a series of war loans floated by the British government on the New York financial markets in the early months of 1917. The eventual form of the loans consisted in 20-year government bonds, paying 5½ per cent interest. Investors were promised principal and interest payable at the investors’ option at the offices of J. P. Morgan and Co. in New York or London. (Morgans had acted as the British government’s procurement agents in the U.S.A. since 1915. They were also its bankers, offering overdraft facilities. Around the time the loans were floated, the overdraft had grown to some US $345 m, which is about £3.4 bn in today’s currency).

The reason for inserting the gold form of payment clause into the contracts was to protect investors against the risk of currency depreciation or adverse movements in exchange rates. In simplified form, the payment clause provided that investors were to receive the principal and interest thereon either in New York “in gold coin of the United States of America of the standard weight and fineness existing February 1, 1917” or in London “in sterling money at the fixed rate of $4.86½ to the pound”. 1: 4.866 was the pre-War gold-standard parity between sterling and the dollar. Gold clauses of this kind were a regular feature of international investment contracts, particularly those of long duration.

The question for the House of Lords was how the British government should discharge its debts. For by 1937, the very events hedged against by the investors had happened. During the monetary turmoil of the late 1920s and early 1930s, Britain dropped out of the gold standard. From 1931, sterling became a fiat currency with a floating value in the exchange markets. During 1933, the newly-elected government of President Roosevelt devalued the U.S. dollar by about 41%. A Joint Resolution of the U.S. Congress nationalised all private holdings of gold and gold coin, prohibited the free export of gold bullion, and – citing public policy – barred the enforcement of gold clauses. The U.S. Supreme Court had already held that the Joint Resolution lawfully repudiated gold clauses in private contractual bargains: Norman v Baltimore and Ohio Railroad Co. 294 U.S. 240 (1935). The Resolution provided that gold clauses must be paid “dollar for dollar” at the nominal amount. Foreign investors stood to lose 41% of the original gold value of their advances.

It is worth pausing to say something about the place of the 1917 loan in the larger financing of the War. The total value of the loan was US $250 million, a sum equivalent in today’s currency to some £2.49 billion. However great that sum may seem, it must be set against British government expenditure in the early months of 1917. Britain was spending about US $250 million every month in the United States. Loans and credits financed the purchase of essential food and munitions for Britain and the Allies. Just as importantly, U.S. dollar loans enabled the British government to intervene in the foreign currency markets to support the sterling-dollar exchange rate. The international gold standard between Great Britain and the United States was practically suspended during the war. The British government struggled to manage sterling at its pre-War gold parity. In ordinary times, the excess of imports from the United States would have triggered a flow of gold specie from Britain. But the wartime trade imbalances were on such a scale that they would have drained Britain’s gold reserves. Had this happened, domestic and international confidence in sterling would have collapsed, and with it Britain’s ability to keep waging the war.

The situation was precarious. America remained technically neutral, and support there for Britain and the Allies was equivocal at best. Britain had dangerously raised the stakes in 1915 when its prize courts condemned certain American ships carrying food exports through agents in Scandinavia to Germany. (The cargo seizures were themselves the subject of appellate litigation: The Louisiana [1918] A.C. 461). The war was financed from month to month, and late in 1916 the coffers of the British Treasury were nearly empty. In November that year, the U.S. Federal Reserve had issued formal warnings cautioning banks and private citizens against investing too heavily in short-term foreign government securities. All these events conspired to undermine British attempts to raise money in the financial markets.

Twenty years on, the same events still coloured the House of Lords’ view of the gold clauses in the bonds. The central legal question was whether the bonds were governed by U.S. law. If so, the Joint Resolution of Congress would have barred payment at anything but nominal rates. In the result, the House of Lords unanimously held that the U.S. law applied. Investors claiming redemption of the bonds in New York were only to receive the nominal dollar value of their bonds. Investors claiming payment in London would receive sterling at the agreed rate of exchange on the nominal U.S. dollar sum.

The Lords’ reasoning does not read as a dry inquiry into which system of law the parties intended to govern the contract. Context was one indicator of their implied intention. Notably, Lord Maugham’s speech reads as a blunt assessment of 1917 Realpolitik. He listed the political facts and wartime events in the years and months either side of the floatation of the loan, running from the sinking of the Lusitania in 1915, Germany’s announcement of unrestricted submarine warfare the very day before the loans were issued, to the recall of the U.S. and German ambassadors shortly afterwards. For Lord Maugham, the entry of the United States into the war was inevitable. Whether or not he was right about this, he clearly considered that the British government had to accept the loan on whatever terms the U.S. government wanted, including subjecting itself to American law. The former rule, that when a sovereign state bound itself by contract then its own law applied to the obligations created, was untenable in the circumstances of 1917 (cf. Smith v Weguelin (1869) L.R. 8 Eq. 198).

By 1937, however, the British government must have been glad of this result. As a debtor for a sum measured in U.S. dollars, it stood to benefit from President Roosevelt’s devaluation of the dollar as much as Roosevelt’s own government might have. If the gold clause had been enforced on its agreed terms, the government’s outstanding debt would have been 41% greater. Indeed, the British government seemed to fare even better from the devaluation than the government in the United States. In Perry v United States 294 U.S. 330 (1935), the Supreme Court held that Congress could not use its constitutional powers to fix the monetary standard in order to reduce the real value of its own debts owed to investors in wartime Liberty Bonds. By definition, that constitutional protection did not extend to investors enforcing dollar debts against foreign governments. The U.S. Constitution did not bind the British government.

Putting aside the exigencies of wartime finance, we might ask why gold clauses were so legally fraught. It is only a partial answer to say that they marked a point of conflict between private parties’ bargaining autonomy and the state’s sovereign interest in managing its own monetary system. The reasons were more fundamental. When private parties inserted a gold clause they did the very thing that it was the state’s prerogative to do in defining its national monetary standard. This point only becomes apparent by reading the contemporary writings on the nature of the gold standard. Of these, Ralph Hawtrey’s Monetary Reconstruction (2nd edition, 1927) stands out for the clarity of its insight. He wrote at pp 37-38:

“When we speak of a monetary standard we mean that which regulates the value of the purchasing power of the monetary unit … But it is a mistake to suppose that [a monetary standard] is merely a standard of value, no more than a unit for the comparison of different items of wealth … The true function of the monetary standard is so to regulate the unit in which debts are measured as to maintain the stability of that system”.

Monetary units such the pound or the dollar were just empty units for expressing comparisons among different items of wealth. They enabled quantities of one thing to be aligned in a numerical relationship with quantities of another. The purchasing power of each unit was not something inherent within it. The purchasing power could only be ascertained by a relationship of convertibility between the unit and a certain commodity – gold – which existed in stable quantities and for which there was a universal and constant demand.

Developing Hawtrey’s view, the parties who inserted gold clauses were seeking to fix the purchasing power of the monetary units used in their contract. Moreover, they fixed it de futuro seeking to make it bind for the full duration of the contract. Their private contract mimicked the state’s own prerogative to control the purchasing power of its circulating currency. When that mimicry amounted to the illegitimate appropriation of the state’s prerogative, the courts declined to enforce the agreed terms of the contract.

All state currencies now work on a fiat standard where their purchasing power is unrelated to the value of gold. Nonetheless, some lessons from the Bondholders’ case endure. Parties who provide for money payments in their contracts never enjoy complete control over the subject of the obligation. The money they bargain for is a public good rather than a private commodity. The state has an interest in their contract and it will, if need be, frustrate the parties’ private intentions. True, money can be owed and owned. But these private law conceptions of money cannot exclude the fundamental monetary control that the state reserves for itself.

*Prepared as part of the ‘Project on the life and work of F.A. Mann’, based at the Centre for British Studies, Humbolt University of Berlin: http://fam.iuscomp.org/mann A full version of the paper from which this blog post is taken is available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4194592

It is a wonderful post. Thanks.