Should the EU introduce a carbon border tax?

Executive Summary

- As part of its “Fit for 55” policy package, the EU plans the introduction of a Carbon Border Adjustment Mechanism (CBAM) to avoid carbon leakage and ensure the competitiveness of EU firms.

- Rather than introduce the CBAM, the EU should phase out the allocation of free Emission Trading Scheme (ETS) allowances until 2026 and focus on supporting low-carbon innovation in carbon-intensive sectors via environmental regulation.

- It should at the same time license these innovations cost-free to developing countries to adhere to the fairness principles of the Paris Agreement.

Introduction

To meet its revised emissions reduction target of 55% compared to 1990, the EU announced in July 2021 the “Fit for 55” (1) package with 13 interrelated legislative proposals (2). More stringent climate regulation in the EU will likely result in higher carbon prices and theoretically increase the probability of carbon leakage. To help create equal opportunities for EU versus non-EU firms (3), the Union, therefore, plans the introduction of a carbon border tax.

Two distinct channels of carbon leakage

- Competitiveness: Higher carbon prices increase EU production costs, putting foreign producers with less stringent carbon regulation at a comparative advantage (4). Consumers and producers in the EU might substitute more expensive domestic goods with cheaper but more carbon-intensive foreign ones. In the long run, domestic producers might relocate production facilities to jurisdictions with lower carbon regulations.

- Energy: Higher carbon prices may reduce the demand for carbon-intensive products in the EU which in turn could lead to a reduction in fossil fuel prices globally. This may in turn increase carbon-intensive consumption in countries with less ambitious climate regulation (4).

While the competitiveness channel can be addressed with the CBAM, the energy channel can only be addressed with a global carbon price (5).

The risk of carbon leakage

25% of global emissions can be linked to international trade from jurisdictions without to jurisdictions with carbon regulations (6), potentially undermining the effectiveness of carbon pricing and leading to leakage (4). From 2004 to 2012 Branger and Quirion (5) evaluated ex-ante the degree of carbon leakage associated with a hypothetical carbon price based on the results of 25 studies. They found moderate levels of carbon leakage, on average 14% without and 6% with CBAM policies for companies operating in energy-intensive and trade-exposed sectors. Alternative studies with a similar focus (4) point to higher leakage rates between 20% and 70%. To prevent leakage, ETS allowances for EU companies in heavy industry have up to now been allocated cost-free (2).

The EU’s carbon border tax design

During an introductory period from 2023 – 2026, importers would start reporting emissions while CBAM would be phased in (2). Starting in 2026, the EU plans to introduce a CBAM for five sectors (2)–iron, steel, cement, fertilizer, aluminium, and electricity generation–where the threat of carbon leakage is considered the greatest. Importers would be required to submit a corresponding number of CBAM certificates (2), which will be linked to the direct emissions generated during the production process of the goods imported into the EU. The price of these certificates will be identical to the weekly carbon price trading in EU ETS auctions. Simultaneously, free allowances would be phased out gradually by 10% annually, until 2036.

Shortcomings of the CBAM proposal

CBAM essentially represents a trade tariff – therefore the risk of retaliation (7) from important trade partners like China and Russia (Figure 1) is high; for example via tariffs on automobile imports into the EU.

Figure 1: Intensity of CO2 emissions embodied in total gross exports of final products in 2015 (in tonnes per $ million for six lowest and highest countries), by Georg Zachmann, based on OECD data, reproduced with permission.

CBAM delays the phasing out of free allowances for energy-intensive sectors to 2036 (8). Since the policy announcement, the EU carbon price has surged from an average of EUR 25 per tonne of CO2 in 2019-2020 (9) to EUR 84 (10). With the current proposal, however, producers in heavy industries are currently paying a carbon price of zero and it would take another 15 years until they would pay the full carbon price (11). This may delay their incentive to switch to low carbon production methods which are urgently needed to achieve progress in meeting the reduction target.

CBAM only targets imports of raw materials – this could shift EU imports towards downstream products, such as nails, tacks and pins (7) and hurt domestic production since demand for similar, but more expensive products from the EU might decline.

Introducing CBAM is costly and associated with a high administrative burden (7). It is unclear how the EU plans to administer countries with an ETS not linked to their own but with a higher carbon price or countries with a carbon tax rather than an ETS (12).

CBAM favors carbon-efficient versus carbon-intensive importers and puts developing countries with fewer means to switch to carbon-reducing production methods at a competitive disadvantage (13). This is against the “common but differentiated principles” of the Paris Agreement (12).

Recommendations going forward

Rather than introducing CBAM, the EU should phase out free allowances by 2026 and focus on environmental regulation that stimulates and supports low carbon innovation (14) for carbon-intensive goods. To achieve this, the EU could introduce carbon-intensity benchmarks for industrial sectors like steel, for example EU firms would need to achieve a carbon intensity below 0.75 tonnes of CO2 per tonne of non-recycled steel versus the industry average of 1.5 tonne of CO2 (7). Companies beating the benchmark would get access to a low carbon fund, financed through the auctioning income from carbon allowances. The best 10% would furthermore receive free allowances.

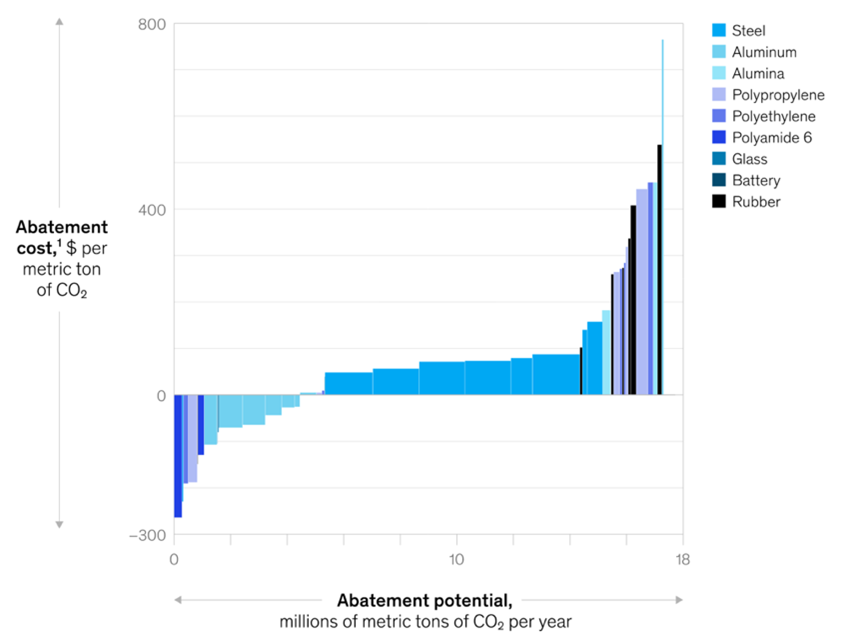

Such a proposal would strengthen the competitiveness of high-emitting EU firms who, subject to more stringent carbon regulation, could emerge as low carbon leaders (7). The Marginal Abatement Cost Curve (MACC) in Figure 2 (15) demonstrates a case in example. The marginal cost to develop low carbon steel starts at USD 50 per tonne of CO2 and rises to about USD 150. Eliminating the free allocation of allowances would immediately expose EU steel producers to the current carbon price of EUR 84 per tonne of CO2 and incentivize the development of “green” steel (16).

Figure 2: Illustrative MAC curve for the value chain of European auto companies, whose upstream emissions are due to the sourcing of raw materials such as steel and aluminum, Source: McKinsey, 2021. Reproduced with permission.

The EU should furthermore license low carbon technologies cost-free to developing countries who are the lowest GHG emitters but are most impacted by climate change and have the fewest resources to develop carbon-reducing technologies. Finally, the EU’s diplomacy efforts should focus on promoting a global carbon price (12), thereby eliminating carbon leakage once and for all.

References

- EU. European Green Deal: Commission proposes transformation of EU economy and society to meet climate ambitions 2021 [Available from: https://ec.europa.eu/commission/presscorner/detail/en/IP_21_3541. Access date: 16th October 2021.

- EU. Policy Proposal Carbon Border Adjustment Mechanism. 2021.

- Harris J, Roach B. Environmental and natural resource economics: a contemporary approach, Chapter 13: Global Development and Environment Institute, Tufts University; 2021.

- Cosbey A, Droege S, Fischer C, Munnings C. Developing Guidance for Implementing Border Carbon Adjustments: Lessons, Cautions, and Research Needs from the Literature. Review of Environmental Economics and Policy. 2019;13(1):3-22.

- Branger F, Quirion P. Would border carbon adjustments prevent carbon leakage and heavy industry competitiveness losses? Insights from a meta-analysis of recent economic studies. Ecological Economics. 2014;99:29-39.

- Sakai M, Barrett J. Border carbon adjustments: Addressing emissions embodied in trade. Science Direct. 2016(Energy Policy 92 (2016) 102 – 110).

- Zachmann G, McWilliam B. A European carbon border tax: much pain, little gain. 2020.

- Blot E. Fit for 55 package extends EU carbon price signal to two thirds of emissions by 2030. Institue European and Environmental Policy; 2021.

- Fitch. High EU carbon prices to weigh on steelmakers profitability 2021 [Available from: https://www.fitchratings.com/research/corporate-finance/high-eu-carbon-prices-to-weigh-on-steelmakers-profitability-12-05-2021. Access date: 17th October 2021.

- Ember. Daily carbon prices 2021 [Available from: https://ember-climate.org/data/carbon-price-viewer/. Access date: 24th October 2021.

- Quercia P. Polluting for profit: the paradox of the emissions trading system: Instituto Affari Internazionali; 2019 [Available from: https://www.iai.it/en/pubblicazioni/polluting-profit-paradox-eus-emissions-trading-system. Access date: 23rd October 2021.

- Sapir A. The European Union’s carbon border mechanism and the WTO: Bruegel; 2021 [Available from: https://www.bruegel.org/2021/07/the-european-unions-carbon-border-mechanism-and-the-wto/. Access date: 23rd October 2021.

- Böhringer C, Balistreri EJ, Rutherford TF. The role of border carbon adjustment in unilateral climate policy: Overview of an Energy Modeling Forum study (EMF 29). Energy Economics. 2012;34(SUPPL.2):S97-S110.

- Porter ME, Van Der Linde C. Toward a new conception of the environment-competitiveness relationship. Corporate Environmental Responsibility2017. p. 61-82.

- McKinsey. Net zero or bust: Beating the abatement cost curve for growth 2021 [Available from: https://www.mckinsey.com/business-functions/operations/our-insights/net-zero-or-bust-beating-the-abatement-cost-curve-for-growth#. Access date: 24th October 2021.

- Guardian. Green steel: Swedish company ships first batch without using coal [Available from: https://www.theguardian.com/science/2021/aug/19/green-steel-swedish-company-ships-first-batch-made-without-using-coal. Access date: 25th October 2021.

This post is an edited version of a policy brief submitted as part of the summative assessment of the Carbon Economics 2021-22 course.

Banner image: The EU borders. Source: Wikimedia Commons (https://commons.wikimedia.org/wiki/File:European_Union_borders.png) /Paolos (https://commons.wikimedia.org/wiki/User:Sinigagl), shared under the Creative Commons Attribution-Share Alike 3.0 Unported license (https://creativecommons.org/licenses/by-sa/3.0/deed.en). No changes were made to the image.

Recent comments