Thursday 5th of February was a special day for Caliphal Finances as the first PhD of the project was very successfully defended by Dr Dalia Hussein who passed with no corrections!

Dalia’s PhD is entitled: Ownership, Tax and State: Land Use in Abbasid Egypt (abstract below).

The viva allowed for a stimulating conversation with the examiners, Prof Chris Whickham (Oxford) and Dr Nik Matheou (Edinburgh), ranging from the extent of Abbasid control in Egypt, the incentives of becoming a tax guarantor for the Abbasid state, the modes of extraction in cash and in kind, the organisation of tax assessment for the land of Egypt that covered 3,5 million hectares in the modern period. Much more was discussed and will go into the forthcoming publication of this PhD dissertation and in the chapter that Dalia is writing on the concepts of qabāla and ḍamān for the forthcoming Caliphal Finances output, a Handbook of Fiscal History in the Early Islamic World (7th-10th century).

For more on this, see: Call for Contributions is Closed! Handbook of Fiscal History in the Early Islamic World (7th-10th century) – Welcome to the Caliphal Finances Blog

Many congratulations to Dalia for this wonderful achievement!

Ownership, Tax and State: Land Use in Abbasid Egypt

Abstract

The dissertation studies the ownership of agricultural lands and the taxes levied on them in Egypt during Abbasid rule (from 132/750 to 358/969). It seeks to test the involvement of the Abbasid caliphal centre in the control of the lands and revenues of the province of Egypt. These issues are studied relying on the extant documents (papyri) which include tax receipts, land leases, accounts and letters, in dialogue with the narrative sources and legal works produced in Egypt during the period of study. The thesis sheds light on some under-studied documents and narratives relating to the periods of Ṭūlūnid and Ikhshīdid governorships in Egypt.

Chapter 1 shows evidence of agricultural lands held in private property in documents and in the works of jurists, arguing that a notion of full private ownership of lands existed during that time and showing that two types of lands co-existed in Abbasid Egypt: private lands and state-owned lands. This distinction and its implication have not been studied in detail by the previous scholars. The Abbasid household and elites held agricultural lands in private ownership in Egypt, thus attempting to control parts of its lands and revenues. Chapter 2 addresses the land tax to show that the same land tax was applied to private and state-owned lands according to the documents including available tax receipts. The chapter discusses the tax base and how it was assessed, demonstrating that assessment was based on acreage in Egypt, which was not case in other regions of the caliphate. Chapter 3 studies the collection of the land tax, how many instalments were paid, and who collected it. The caliphal authorities is not visible in this collection process, leaving it to the discretion of the provincial authorities. Finally, chapter 4 discusses the contractual fiscal arrangements made with the state regarding the collection of the land tax, arguing, based on the documents and the narrative sources, that a system of guarantee of payment of the land tax – rather than the catch-all ‘tax farming’ category – was an integral part of the fiscal system.

In conclusion, the study demonstrates an involvement of the caliphal centre attempting to control the province’s lands and revenues which was not always successful and became weaker in the Ṭūlūnid and Ikhshīdid period. It also shows the wide range of information the surviving documents can provide, especially when studied in conjunction with contemporary narrative sources and legal works, while, at the same time, points at the limitations of these documents, giving less information about other important aspects.

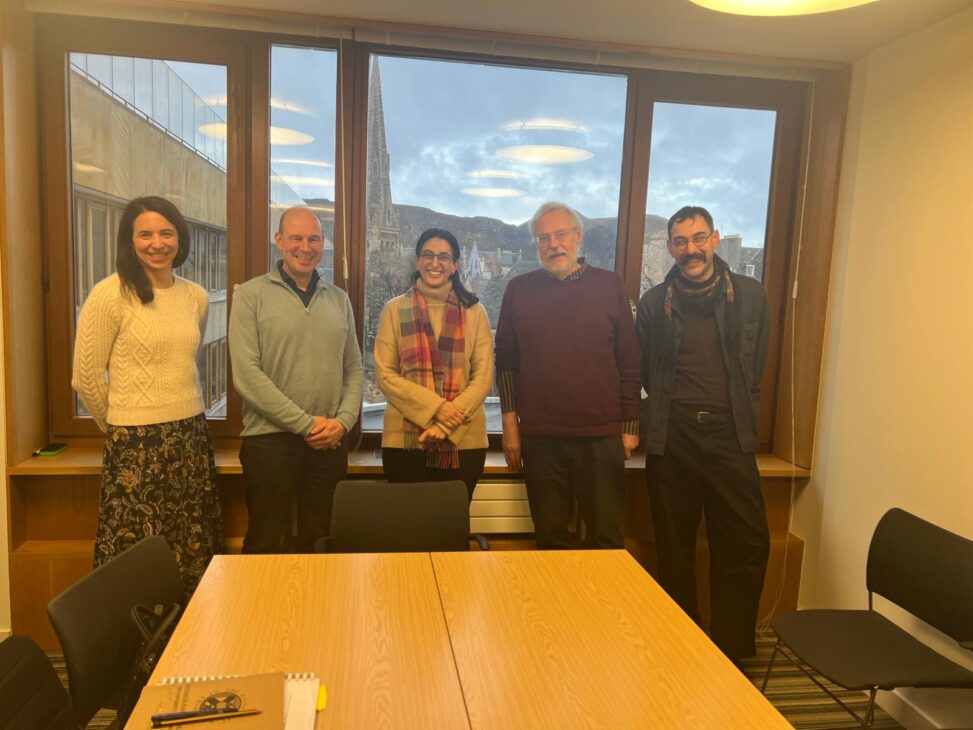

Banner image: Dalia Hussein (middle) surrounded by her very happy supervisors (left) Marie Legendre and Andreas Görke and examiners (right) Chris Wickham (Oxford) and Nik Matheou (Edinburgh).

Leave a Reply