On 27th and 28th October, the Caliphal Finances team was very happy to welcome Arietta Papaconstantinou, Professor of the History of the Byzantine World at Aix-Marseille University.

On Monday, we started our discussions with Arietta briefly introducing her new ERC project, “The Imperial Encounter in Early Islamic Egypt: Dissecting the Aphrodito Archive” (Imperial Encounter), which will start early 2026 at Aix-Marseille University. While the project will not focus on fiscal matters, it will likely not escape taxes (as one famously can’t), as it studies the dynamics of empire from the so-called Aphrodito archive, the administrative archive of a local administrator in the Nile Valley in the early 8th century. That morning, we discussed various topics related to late antique and early Islamic taxation, such as the narrative that exists in scholarship on the oppressiveness of early Islamic taxation and how it compared to Roman fiscal practice, the redistribution of collected taxes in the Egyptian province, the private wealth of tax officials vs. the public wealth of the provincial treasury, and tax farming. We kept these conversations going during lunch before returning to Marie’s office for the afternoon session.

The Caliphal Finances team with Arietta Papaconstantinou in Edinburgh, 27th October 2025.

The afternoon’s discussions centred around questions about what was demanded and accepted as tax, and how different links in the fiscal chain handled the demands of empire. Georgi Obatnin, PhD student attached to the project, presented a theme of his PhD research, the fiscal concept and practice of adaeration, or the substitution of payment in kind with a cash equivalent. We discussed requisitioned labour, monetization, and the economic power of rural elites. We also talked about related topics that are part of PI Marie Legendre’s and postdoc Noëmie Lucas’ research, specifically dynamics of centralization and what that actually meant in terms of tax assessment, and the transfer of collected revenue from the province to the caliphal capital.

Discussions on the second day of Arietta’s visit, 28th October 2025.

On Tuesday, we moved on from the early 8th century and focused our discussions more on the Abbasid period. In the morning we and our guest discussed a chapter from PhD student Dalia Hussein’s PhD, which we had read beforehand. Based on a study of Abbasid tax receipts from Egypt, the chapter focuses on the land tax, specifically on questions of when it was paid, the fiscal calendar, and who collected it from the taxpayer. After a lunch with further stimulating discussions on empire and fiscality, we returned for our final session to discuss Noëmie’s work-in-progress research on financial directors, specifically those active in Egypt during the caliphate of Hārūn al-Rashīd. Noëmie’s research, which will take the form of a research article, will provide a list of financial directors in that timespan, as well as a discussion of their various prerogatives and how they interacted with the responsibilities of the financial governors.

We thank our guest Arietta Papaconstantinou for spending these two days with us and sharing her time and expertise to explore various socio-economic dimensions of early Islamic fiscal practice!

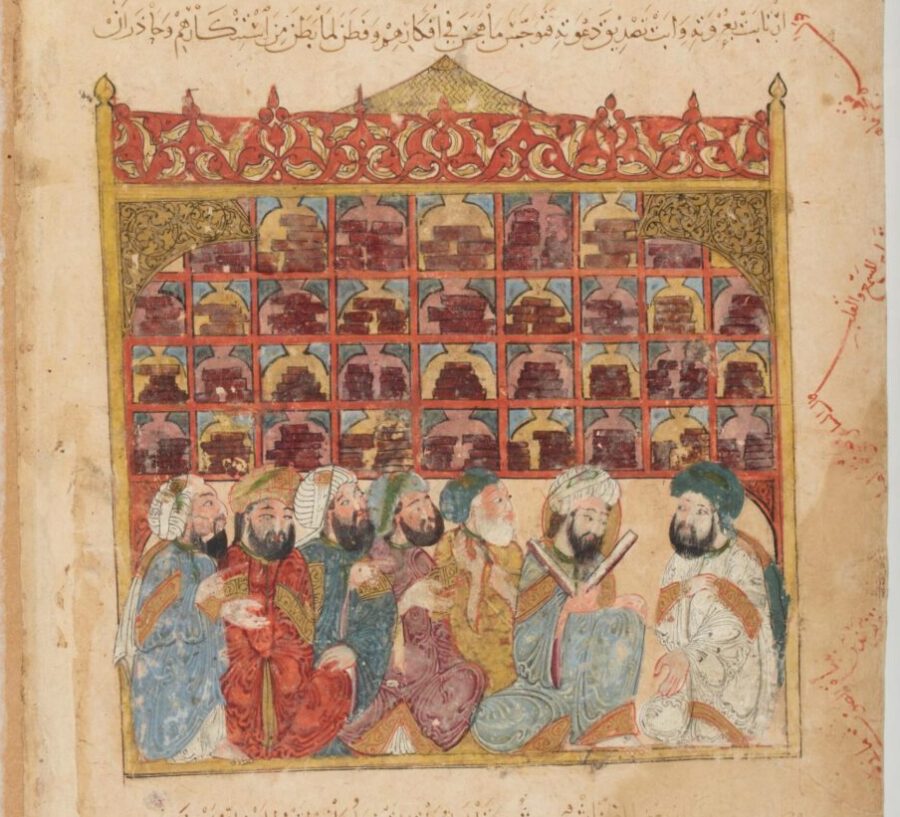

Banner image: Ḥarīrī, A. & Wāsiṭī, Y. I. M. (1236) The Assemblies of al-Hariri. [Place of Publication Not Identified: Publisher Not Identified, to 1237] Retrieved from the Library of Congress, https://www.loc.gov/item/2021667393/.

Leave a Reply