The Trouble with Taxation: Tax Revolts and Discourses against Fiscal Policies

Last September, SCORE and Caliphal Finances teamed up to organize a two-day informal workshop at the University of Edinburgh (4-5 September 2023). This event was organized with the generous support of the ‘Balzan Seminar on the Formation, Maintenance, and Failure of States in the Muslim World before 1800’, directed by Michael Cook from Princeton University, Antoine Borrut from the University of Maryland, and Marie Legendre. SCORE, ‘Social Contexts of Rebellion in the Early Islamic Period’, is a DFG research group based in Hamburg and led by Hannah-Lena Hagemann, with whom the Caliphal Finances team has been in contact since 2021.

The idea of this workshop quickly became evident to both our teams. Our subjects overlap on the precise question of the intersection between taxation and the revolts or forms of opposition associated with taxation. As part of Noëmie Lucas’s research in the ERC project, she is particularly interested in the so-called fiscal revolts that took place in Egypt in the 8th and 9th centuries. It was in this context that she spent two weeks in Hamburg in June 2022 to work with Hannah and her team on this topic. She also presented her initial findings on this theme in November 2022 at the SCORE lecture series online, with a lecture on the 785 Arab revolt that occurred in the Egyptian Delta, entitled When the Arabs Refused to Pay Taxes. The Egyptian Delta Between Revolt and Allegiance in the Abbasid Period. (To watch it: Score Lecture Series (Winter Term 2022/2023)) The subject of tax increases and oppressive taxation leading to revolts was tackled by Marie Legendre in September 2022 at the SCORE conference devoted to “The Theory and Practice of Rebellion in the Early Islamicate World”. She examined the first decades of uprisings documented in Egypt in the long 8th century from the perspective of papyrus. This workshop provided an opportunity to build on our research into these issues and to enrich it with a variety of different viewpoints.

During those two days, we explored oppositions to tax policies from discourses to revolts in the early Islamic period, examining different geographical and political contexts (Sicily and North Africa, Egypt, Iraq, the Hijaz, and Byzantium). This workshop gathered nine researchers who shared ongoing research or offered responses. Colleagues and PhD students from the University of Edinburgh also joined us and participated actively in the discussions.

Among the themes we addressed were:

- Governance and the related topics of justice/injustice, loyalty, connections, and allegiance, and the relationship between taxation and the state.

- Tax revolts, exploring questions such as:

- Are tax revolts really about taxes?

- Does rebellion actually stop tax collection?

- How do sources connect taxation and rebellion, and to what extent is this a trope?

- Does tax compliance embody compliance with the state and/or acceptance of its legitimacy?

- Practicalities of revolt, including preparation and infrastructure, tax collection in practice, and the territories of rebellion.

You can find the programme of the workshop here: Trouble with Taxation_Programme

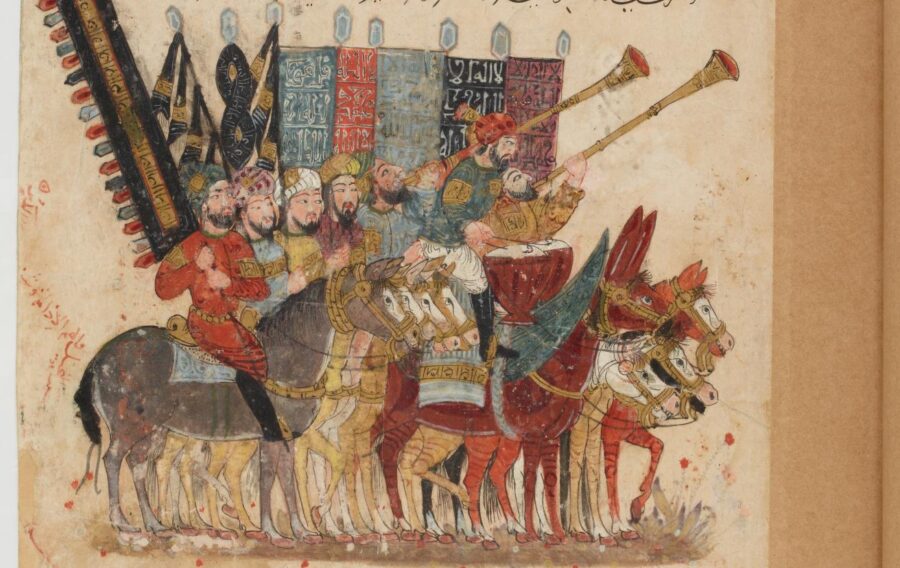

Credit: Ḥarīrī, A. & Wāsiṭī, Y. I. M. (1236) The Assemblies of al-Hariri. page 47 Retrieved from the Library of Congress, https://www.loc.gov/item/2021667393/. World Digital Library

Leave a Reply