Keywords: Green purchase, circular economy behaviour, challenges, waste management

Since the Industrial Revolution, both productivity and capitalism trajectory have increased significantly. For over 2.5 centuries, we have seen the proof that the linear economy (“make-use-dispose”, “take-make-use-dispose”) is not sustainable. On the other hand, the Circular Economy offers the opposite. Defined by Morseletto, P. (2023) as an economic framework aimed at the conscious and efficient use of products and resources through their reuse, reduction and recirculation, long-term value retention, and closing loops in production/consumption (i.e., recycling resources and minimising waste).

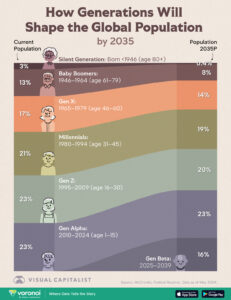

Figure 1. Current population percentage by generation. source: https://www.visualcapitalist.com/visualizing-the-global-population-in-2035-by-generation/?utm_source=chatgpt.com

From the figure, we can see that the current top two emerging generations are Generation Z (23%) and Generation Y (Millennials) (21%). The combination of both represents more than half of the current population. From the age of 16-45 years old, these generations are in their productive age and their consumption shapes the future world. The author found an interesting paper written by Ramadhanti, F., Suryandaru, R., Amelia, N. (2024) that investigates the role of young consumers (Generation Y & Z) in green purchasing behaviour toward circular packaging in Indonesia. The research found that green purchase intention is influenced by self-claiming identity as a “green” person, behaviour towards the environment, and influenced by socialisation agents (i.e., family, peer, and media exposure). Where consumers with green purchase intentions will highly likely adapt to green shopping behaviour.

From the green seller side (in this case bulk/refill shops), the Author found a similar pattern. According to a study conducted by GIZ (2022, pp.40-41]), out of 18 bulk/refill shops are adopting a social entrepreneurship business model. Where this business targets a specific market, consumers share environmental and social concerns and mindfulness. How many Indonesian consumers fulfil this checklist do we think? If we want to improve the linear economy and waste management problems, don’t we have to upscale this effort (reduce waste from the source)? For the record, regardless of this business model putting aside the economic drive, this study has proven that at least 18 out of 47 stores (that were willing to be interviewed) have existed for 2-7 years.

Plastic packaging was initially invented to protect the goods it carries inside, ironically the same item has successfully become a substantial environmental problem in Indonesia. Bulk/refill shops offer solutions to this single-use plastic packaging problem. Single-use plastic packaging such as sachets dominate (57%) the type of plastic consumption in Indonesia (BPOM, 2019). One of the respondents in this study sensibly bridges the needs across consumer categories, Siklus Refill. Siklus Refill offers delivery service, flexibility in reusable packaging regulation (including without minimum purchase) and competitive prices.

Other than solving the waste problem from the root, the paper believes that bulk/refill shops will generate more job opportunities, especially for small-medium enterprises, local craftsmen and farmers. Quoting the paper

“An increase in the number of bulk/refill stores has implications for an increase in the number of consumers with an eco-friendly shopping lifestyle. This will increase the demand for products or outlets that sell bulk/refill products in shopping centres, modern shops, and traditional markets. This is expected to encourage distributors to be able to distribute/sell bulk/refill products to remote areas of Indonesia.”

Then why is this intervention not fully fledged yet? The paper proof to support the refill/bulk shops, we need a strong ecosystem. This is not one stakeholder’s job, below are the summarised suggestions outlined in the papers.

Table 1. Summary of Stakeholder's Role to Support Refill/Bulk Shops

| Manufacturers

i.e., Fast-Moving Consumer Goods (FMCG) |

Internal bulk/refill shops | Indonesian Chamber of

Commerce and Industry, Government Ministries/Agencies |

3rd party, Non-government Organisations (NGO), etc. |

|

|

|

To provide technical, socialisation/mediation, implementation support, and others. |

Leave a Reply