Caliphal Finances

A five-year, European Research Council-funded project to provide for the first time a view ‘from below’ on Abbasid fiscal history through a study of papyrus documents in Greek, Coptic and Arabic written in Egypt.

The Finances of the Caliphate: Abbasid Fiscal Practice in Islamic Late Antiquity

Running from 2021-2027, this project will offer an ambitious new account of a landmark period in Islamic history.

What is this research about?

The Abbasids were the second longest ruling dynasty in Islamic history (750-1258). The first centuries of their rise to power are of key importance for the history of Islam, as the earliest surviving literary texts written by Muslims (religious, legal and fiscal treatises, grammars and poetry) were composed at this time and in their capital, Baghdad. They have been the preferred sources for scholars working on this period. As a result, our current view of Abbasid state structures is a view from the top. State policies, however, were not decided by the caliphal centre and Baghdadi administrators alone.

Caliphal Finances will refocus scholarship on the totality of Abbasid administration. It will be the first large-scale research project on Abbasid administrative and fiscal history to make use primarily of documentary sources. Egyptian papyri are concerned with everyday arrangements for fiscal collection in secondary urban centres and villages of the Nile valley. Capitalising on this material, the project will study the organisation of tax collection, tax rates and categories of taxpayers.

The project team will trace how provincial revenues reached the caliph, incorporating information found in provincial chronicles with that in the papyri. Connections between administrators and local elites, religious and linguistic communities, their convergence on fiscal questions, their loyalty or resistance to the caliphate will all be assessed. In a field largely dominated by religious history, Caliphal Finances will renew our understanding of the dynamics of change in pre-modern state structures, with a focus on the complexity of local agency.

Main research questions

- What are the different taxes and the tax rates visible in the documents of Abbasid Egypt?

- Do they match what was prescribed in the Abbasid capital?

- Are the different religious and linguistic communities visible in the organisation of fiscal practice?

- How did changes to the fiscal system impact taxpayers and the economy of the region?

- What was the contribution of taxpayers and local administrators to the shaping of fiscal practice?

- What does fiscal practice in Egypt reveal about the organisation of state structures in the Abbasid empire?

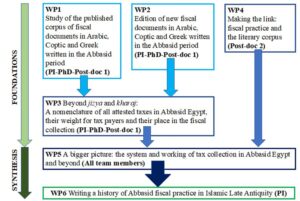

Work Packages

- Work Package 1 Study of the published corpus of fiscal documents in Arabic, Coptic and Greek written in the Abbasid Period

- Work Package 2 Edition of new fiscal documents in Arabic, Coptic and Greek written in the Abbasid Period

- Work Package 3 Beyond jizya and kharaj: a nomenclature of all attested taxes in Abbasid Egypt, their weight for tax payers and their place in the fiscal collection

- Work Package 4 Making the link: fiscal practice and the literary corpus

- Work Package 5 A bigger picture: the system and working of tax collection in Abbasid Egypt and beyond

- Work Package 6 Writing a history of Abbasid fiscal practice in Islamic Late Antiquity

Learn about our team members and their roles in the project.