The administration of taxation in the Abbasid Caliphate generated a substantial amount of paperwork. A fraction of this documentation, in the form of pieces of papyrus and paper written in Arabic, Coptic, and Greek, has been excavated in Egypt and dispersed to various collections, predominantly located in Europe and the United States. These documents provide insight into the management of taxation on the ground. In this blog, our postdoc Eline Scheerlinck provides a first look at the various types of documents that were produced in the context of the Abbasid fiscal administration in Egypt.

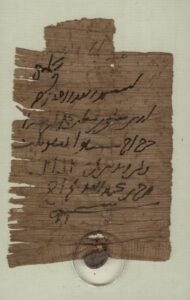

P.GrohmannProbleme 12, a tax receipt for Sulayman, son of Victor

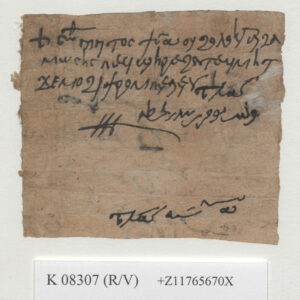

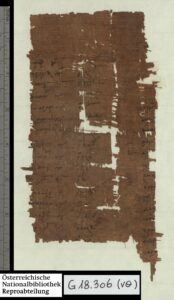

CPR 4 13, a tax receipt for Paitos

Tax receipts were issued upon payment of taxes, and while they are usually very short documents, they are bursting with practical information about the transaction. Typically, we find information such as the name of the taxpayer, the type of tax, the amount that was paid, the year, and the name of the tax collector or other fiscal authority. Hundreds of receipts from the Abbasid period have been published. Taxes could be paid in instalments, which is reflected in the tax receipts. The language of the receipts can be considered highly formulaic, with many receipts following the same pattern of formulas. However, differences between tax receipts point to chronological and geographical variations, as well as to the influence of different scribal traditions. This papyrus tax receipt for Sulayman, son of Victor, was written entirely in Arabic and sealed in 832 CE, when Sulayman paid his land tax or kharāj. The second example is a tax receipt written on paper in 942 CE, for Paitos on behalf of his son, Moses. The scribe produced the receipt in a combination of Greek, Coptic, and Arabic, and as such this document is an excellent example of the multilingual nature of the Abbasid fiscal administration.

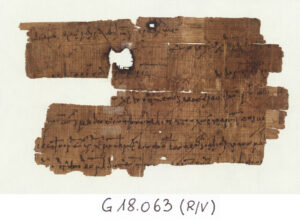

CPR 22 7 recto, model of a tax demand note

Tax demand notes were how the fiscal administration communicated their fiscal demands to the taxpayer. They typically contain very similar information to that found in tax receipts, but sometimes add a word of warning to demand a receipt from the tax collector and not to comply if the tax collector asks for more than what is written in the tax demand note. This is the case in this Greek example of a tax demand note, which actually seems to have been used as a model, as there are spaces left blank for the name of the taxpayer, the name of their village, and the amount to be paid.

CPR 4 197, statement of fiscal reimbursement

Demanding or acknowledging payment were not the only subjects of communication between the fiscal administration and the taxpayers. Whenever the situation warranted, a document could be issued. In this document, a group of seven people sign to confirm that they received a certain sum from a tax collector, as the result of an adjustment by the fiscal administration. This mid-9th century document is written in Coptic, with several loanwords from Arabic pertaining to the fiscal administration.

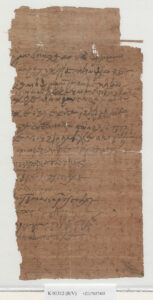

CPR 22 34, a list of abandoned lands

The plethora of published and unpublished fiscal registers and accounts that have been excavated in Egypt were the working documents of the fiscal administration. These documents can be quite difficult to interpret as they often just present lists of names and Greek numerals. However, careful reading and comparison reveal aspects of fiscal practice, and the accounts and lists tell us about the culture of accounting in Abbasid Egypt. This fiscal register lists abandoned pieces of land, recording the names of those who most likely either owned or rented them, why they abandoned the land (the register mentions death or flight), and the size of the land.

These are the main types of fiscal documents that form the core corpus of sources for the Caliphal Finances project. We will be adding more in-depth posts on specific types or particular documents in the future.

All documents highlighted in this blog post are held at the papyrus collection of the Austrian National Library in Vienna, whose database provides the digital images used here. Coptic and Greek documents are cited according to the “Checklist of Editions of Greek, Latin, Demotic, and Coptic Papyri, Ostraca, and Tablets”. Arabic documents are cited according to “The Checklist of Arabic Documents”.

This post has been written by Eline Scheerlinck

Leave a Reply